My how much is car insurance blog 5185

AboutCar Insurance For Young Drivers And Teens - Usaa Things To Know Before You Buy

Lots of teenagers may try to use their driving time to eat their morning breakfast or drink coffee, to use makeup, or to change the radio station. Lots of teens are distracted by the addition of guests in the car.

Share some stories and stats connected to teen drivers and sidetracked driving. Advise your teenager typically that driving is a skill that needs the driver's complete attention. Texts and telephone call can wait till reaching his/her location. with your state's graduated motorist licensing law, and implement its guidelines for your teenager.

Develop your own guidelines if needed. Restricting the variety of guests your teenager can have, or the hours your teenager can drive, is a very efficient method to reduce distraction for your teenager motorist. Talk about the repercussions of distracted driving and make yourself and your teen knowledgeable about your state's penalties for talking or texting on a phone while driving.

If your teenager breaks an interruption guideline you've set, consider suspending your teen's driving privileges, further restricting the hours during which they can drive, or restricting the places where they can drive. Parents could likewise think about restricting a teenager's access to their cell phonea punishment that in today's world could be seen by teens as a major effect.

Cheapest Car Insurance For An 18-year-old Can Be Fun For Everyone

Newbie teen drivers most typically discover from viewing their moms and dads. Guests In a study analyzed by NHTSA, teen motorists were two-and-a-half times more most likely to engage in one or more potentially risky habits when driving with one teenage peer, compared to when driving alone.

Research reveals that the danger of a fatal crash goes up in direct relation to the number of teens in the car. Establish the consequences you will enforce if your teen doesn't comply with the state GDL constraints.

Bottom Line: A lot of state GDL laws limit the number of travelers that can ride in a vehicle driven by a teen. Guests sidetrack an unskilled teenager motorist who need to be focused just on the road, increasing the likelihood of a crash. If your state does not have guest constraints (FL, IA, MS, SD, and ND), develop guidelines with your teen about who can ride with them and the number of people they can have in their vehicle at one time.

SPEEDING Speeding is a critical safety concern for teen motorists. In 2019, it was an element in 27% of the deadly crashes that included guest lorry teen motorists (15-18 years old.) A study by the Governors Highway Security Association (GHSA) found that from 2000-2011, teenagers were associated with 19,447 speeding-related crashes.

The 30-Second Trick For What Is The Cheapest Auto Insurance Rate For An 18-year-old ...

Teens must especially know their speed during inclement https://writeablog.net/megguronsm/it-has-a-slightly-higher-insurance-rate-than-a-few-of-the-other-cars-and-trucks weather condition, when they may need to decrease their speed, or with other road conditions, like traffic stops or winding roads. What Can You Do? Teenagers who are monitored carefully tend to speed less. Take the lead to do more to resolve speeding behavior by your teen motorist and get involved in the learning-to-drive process.

Be constant between the message you inform your teenager and your own driving behaviors. Kids find out from watching their parents.: According to a study by GHSA, when a teenager first has a chauffeur's license, she or he is more likely to speed in their own automobile versus driving the family sedan.

Share this truth sheet on alcohol and driving with your teens and ensure they understand the effects of breaking your state laws on drunk and drugged driving. What Can You Do: that underage drinking, in addition to illicit drug use and over-the-counter and prescription drug abuse, is unlawful and holds severe consequences.

08it is no. Making use of drugs can impact their ability to drive a vehicle securely. This consists of controlled substances, many drugs recommended by a doctor for them or for someone else, and some over-the-counter drugs. Teach your children about zero-tolerance laws, that make it prohibited to drive with any measurable amount of specified drugs in the body.

6 Simple Techniques For Cheapest Car Insurance For 18 Year Olds - Money.co.uk

If there is even a suspicion of alcohol or substance abuse, your teen must decline the flight right away. Let your teenager understand that they can call you or another trusted grownup for a safe trip home if they need one. Remind your teens that they face adult effects for driving after using alcohol or drugs.

In 2019, 45% of teenager drivers who died were unbuckled. Even more troubling, when the teen chauffeur involved in the deadly crash was unbuckled, 9 out of 10 of the guests who passed away were likewise unbuckled.

They may have an incorrect notion that they have the right to select whether or not to buckle up., it's also one of the easiest and most effective actions in reducing the opportunities of death and injury in a crash.

Talk with your teenager about the safety belt laws in your state. Tell your teenager that it threatens and careless to ride in a vehicle unbuckled. Make them knowledgeable about the consequences of not buckling up: tickets, loss of driving opportunities, injury, or even death in case of a crash.

What Does How Much Does Car Insurance Cost For An 18-year-old In ... Mean?

Children who grow up enjoying their parents buckle up are more most likely to buckle up when they end up being motorists. And, prior to you ever take out of the driveway, guarantee all guests are buckled to further impress upon your teenager the importance of buckling up. This isn't a one-time conversation, it's an ongoing effort.

Something as easy as a sticky note in the car can be a practical visual reminder to your teenager driver. Your teen needs to buckle up every journey, as the driver, as a traveler, in the front seat, and in the back. Bottom Line: It only takes a few seconds to buckle up, however it might make the distinction of a life time.

However, with all of these activities, teenagers tend to jeopardize on something very importantsleep. This is a dangerous practice that can cause drowsy driving. In 2019, drowsy driving claimed 697 lives, and some studies even suggest drowsiness may have been involved in more than 10-20 percent of fatal or injury crashes.

https://www.youtube.com/embed/JhV6fU48kfA

Teens and vehicle insurance coverage. Your teenager just got their driver's license. Should they have their cars and truck on their own policy?

AboutWhat Does Insuring Your Teen Driver - Grange Insurance Mean?

Teen Driving Security A teen's very first six months of not being watched driving are the most dangerous, according to 2 different research studies on teenage driving3. Steer your teenager in the best direction! If your teenager is new to driving, please print out and share the following security pointers and cautions. The right idea could save a life.

National General Insurance offers these ideas to improve your teenager safety on the roadway. Share these teenager driving suggestions from National General Insurance that will help keep your high schooler safe on the roadway.

1 Centers for Illness Control and Prevention. (2013 ). Moms and dads are the Key to Safe Teen Drivers 2 Insurance Coverage Institute for Highway Safety. (2018) 3 Insurance Coverage Institute for Highway Safety. (2019 ). Few months of driving not being watched are most dangerous.

Examine This Report on The Best Car Insurance For Teens For 2021 - Verywell Family

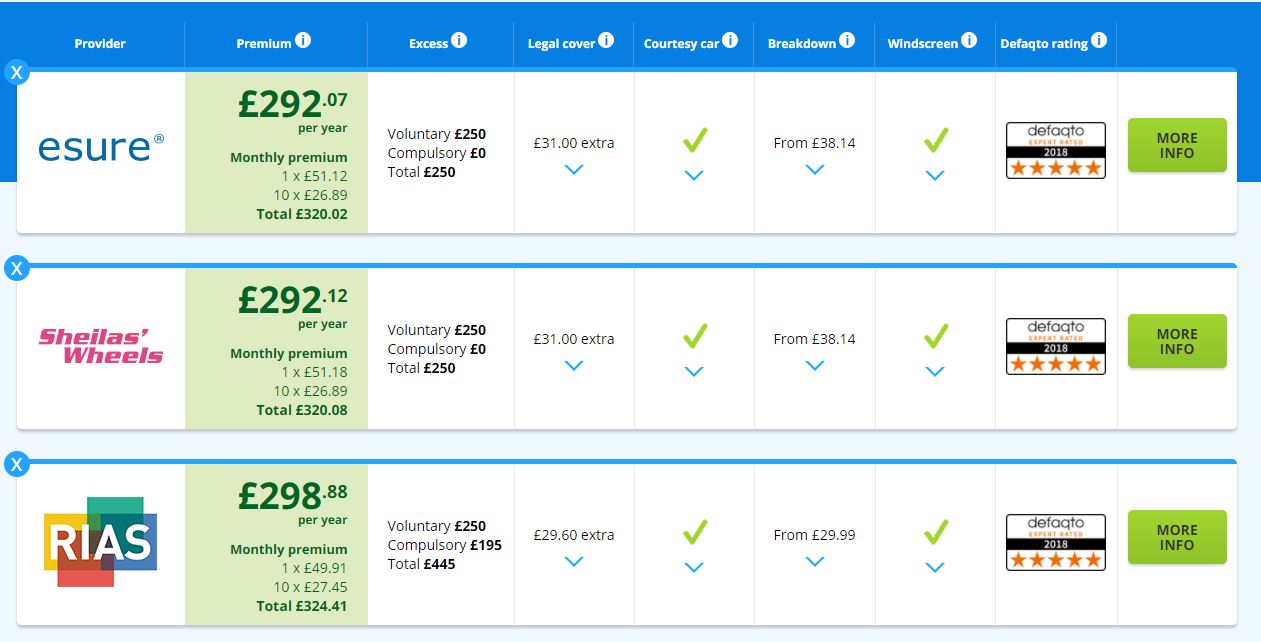

is important for any driver (it's even compulsory in 48 states), however it's especially essential for new drivers, whose lack of experience makes them most likely to have mishaps. Discovering the right policy, nevertheless, can be an obstacle. What sort of coverage do you need? How do you balance expense and protection? Do you truly need crash coverage? It's a lot-- but we're here to assist.

Nationwide 5 things to do before choosing an automobile insurance provider for a teen, Decide if you're getting a separate automobile insurance coverage for your teen or if you desire your teen listed on your insurance. The previous is usually considered cheaper in the short-term as your own auto insurance coverage premium will not go up.

Choose which vehicle insurance protection benefits are crucial to you, and make sure to keep an eye out for them when speaking to an insurance coverage agent. For circumstances, numerous insurers will not extend mishap forgiveness to more youthful chauffeurs, however Nationwide will. Check which vehicle insurance discounts your teen might be eligible to get.

Not known Factual Statements About Car Insurance Tips – Every Teen Driver Must Know - I Drive ...

The business is currently No. 1 when it pertains to client service and satisfaction, and you can trust its reputation when including a young adult to your insurance coverage. Leave it to Geico to use budget-friendly cars and truck insurance coverage that makes things uncomplicated and basic, no matter the task. Geico's specific policy rates vary on a state-by-state basis, but it's regularly ranked amongst the least expensive options in any state.

It likewise provides the exact same discount rates as a lot of its rivals, including benefits for good students and for chauffeurs who have taken driving training courses. Outstanding is that teens that transition from a family policy to their own car insurance coverage may qualify for a 10% Tradition discount rate on their insurance coverage.

Nationwide Car insurance coverage is more costly for teens because of the perception that their inexperience makes them more likely to be associated with accidents. Whether this holds true or not, the fact remains that one in 5 16-year-old drivers gets an accident on their driving record in their very first year behind the wheel.

Excitement About Add Teen Car Insurance To Your Policy - State Farm

Nobody wishes to invest a lot on a car insurance coverage policy, specifically when the car in concern might only be utilized on unusual events. Just the thought of costs thousands a month in insurance costs on an automobile that's often in a car park is stress-inducing. Not only does Progressive use daily low prices, but it's likewise created a series of discounts that use particularly to university student.

, which rewards motorists for driving safely with discounts and other cost savings. Erie Insurance Pennsylvania-based Erie Insurance has been guaranteeing chauffeurs for almost 95 years, and its reputation for sterling service extends to young drivers.

"If there is a young driver on your policy who is ... away at college without a cars and truck," says Ruiz, "you may likewise receive a lower rate." Every insurance carrier offers different discount rates depending upon your coverage choice and other factors, so it pays to examine which ones apply to you before signing up.

The Best Strategy To Use For What Age Does Car Insurance Go Down? - Coverage.com

Progressive offers a range of discount rates for college trainees to save on automobile insurance coverage. The best coverage for you is the one that fits your requirements, addresses your concerns, and makes sense for your scenario.

2021 I Drive Securely We Develop Safer Drivers.

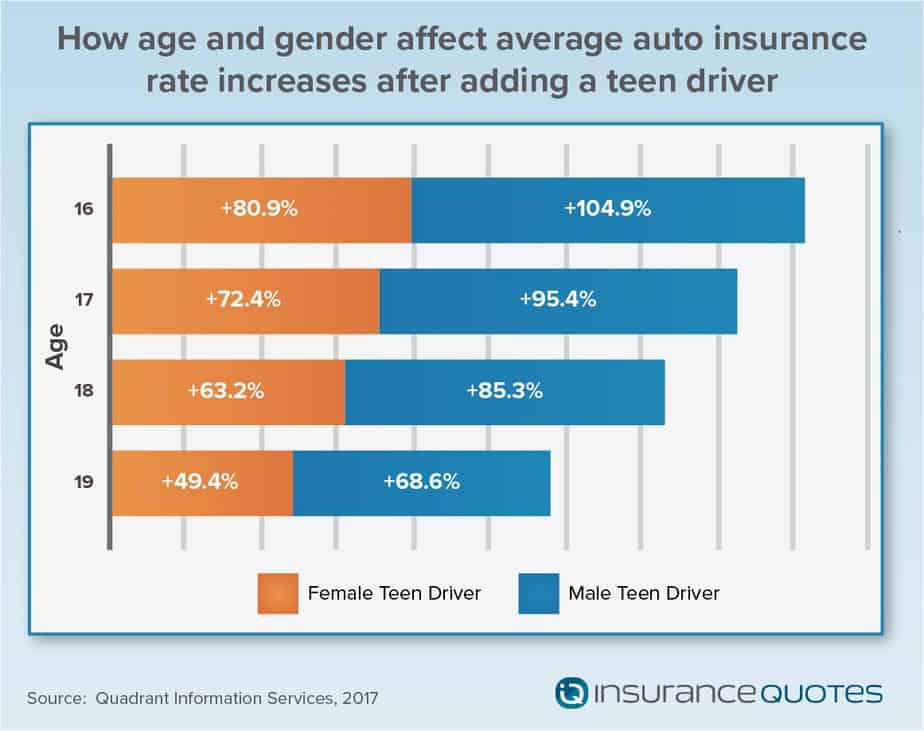

Your child has actually discussed it forever - the day they finally get their motorist's license. However with that brand-new self-reliance comes some huge cost - in the kind of higher insurance coverage rates. Moms and dads of a new teenager driver can anticipate their insurance coverage costs to nearly double, according to a recent study.

Guide To Car Insurance For Teens Can Be Fun For Everyone

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/african-american-teen-learning-to-drive-with-mom-123133825-580f95893df78c2c73b8c4ac.jpg)

Nationally, the typical boost was 79. 73 percent, Insurance, Prices estimate. com reports. For parents of motorists in their teenagers and early 20s - there is some hope. Insurance provider do typically offer a range of discounts that can help lower the bottom line. Here are eight things you can do to reduce auto insurance coverage premiums if you have a teen driver: If your teenager chauffeur is a good trainee you may qualify for discount rates.

Your insurance carrier might provide discount rates if your teenager gets involved in a motorist security course. This might be a formal driver's education course or it may be a course offered by your insurance provider directly.

This depends upon your insurance provider. Note that some insurance provider do dissuade this since numerous students return house frequently and will require insurance coverage to drive the vehicle when they're back. An automobile with extra security choices and greater scores may minimize your premiums. Websites like the Insurance Institute for Highway Safety permit you to look up a car's security ratings.

More About Average Cost Of Car Insurance For 16-year-olds - Valuepenguin

When you've identified the most safe cars and innovation, confirm with your agent whether these will minimize your insurance coverage expenses and by just how much. As a guideline of thumb, an older cars and truck is usually a less costly insurance choice for your teen chauffeur. Pricey, more recent vehicles usually cost more to insure so there might be some savings if your boy or child isn't driving the household's brand-new luxury sedan.

If the vehicle is truly old, you might even think about dropping this coverage all together, if possible. If you have separate insurance coverage providers for your house, car, or other products consider a multipolicy discount rate.

https://www.youtube.com/embed/ZkQZQp9PoyU

Additional sources utilized in this story.

AboutFive Ways To Save On Car Insurance For Teen Drivers for Dummies

Teenager Driving Safety A teen's first six months of without supervision driving are the most unsafe, according to two different studies on teenage driving3. If your teenager is new to driving, please print out and share the following safety suggestions and cautions.

National General Insurance uses these ideas to enhance your teenager safety on the roadway. Share these teenager driving ideas from National General Insurance that will help keep your high schooler safe on the roadway.

2 Insurance Coverage Institute for Highway Safety. (2018) 3 Insurance Coverage Institute for Highway Security. Couple of months of driving without supervision are most dangerous.

Car Insurance For Teens - Teen Auto Insurance - Einsurance - Questions

is important for any chauffeur (it's even necessary in 48 states), but it's particularly essential for new drivers, whose lack of experience makes them more most likely to have mishaps. Discovering the best policy, nevertheless, can be a challenge. What sort of protection do you require? How do you balance cost and coverage? Do you really require crash coverage? It's a lot-- but we're here to assist.

Nationwide 5 things to do prior to selecting a car insurance provider for a teenager, Decide if you're getting a different automobile insurance coverage for your teen or if you want your teen listed on your insurance coverage. The previous is generally considered less expensive in the short-term as your own car insurance coverage premium will not go up.

Decide which cars and truck insurance coverage benefits are very important to you, and make sure to look out for them when talking to an insurance coverage representative. For instance, many insurance companies won't extend accident forgiveness to more youthful motorists, however Nationwide will. Examine which automobile insurance discounts your teen may be eligible to receive.

The Single Strategy To Use For Car Insurance For Teenagers - Fair And Yeager Full Service ...

The company is currently No. 1 when it pertains to consumer service and fulfillment, and you can trust its reputation when adding a young adult to your insurance plan. Leave it to Geico to provide budget friendly cars and truck insurance coverage that makes things uncomplicated and simple, no matter the task. Geico's private policy rates vary on a state-by-state basis, but it's routinely ranked among the most affordable options in any state.

It likewise uses the same discounts as a number of its rivals, consisting of benefits for good trainees and for motorists who have taken driving training courses. Excellent is that teenagers that shift from a family policy to their own car insurance might qualify for a 10% Legacy discount on their insurance.

Nationwide Cars and truck insurance coverage is more expensive for teens because of the perception that their inexperience makes them more most likely to be associated with mishaps. Whether this is real or not, the fact remains that one in five 16-year-old drivers gets an accident on their driving record in their very first year behind the wheel.

Things about Car Insurance Guide For California Teens - Driversed.com

No one wants to invest a lot on a car insurance plan, specifically when the car in question might only be utilized on unusual occasions. Just the thought of costs thousands a month in insurance coverage expenses on a vehicle that's usually in a car park is stress-inducing. Not only does Progressive use everyday low prices, but it's also produced a series of discounts that apply specifically to university student.

Teenagers can likewise benefit from Progressive's Picture program, which rewards motorists for driving safely with discount rates and other cost savings. Progressive's website likewise offers a list of pointers to help parents figure out if they ought to add teenagers on their strategies or get them their own. Erie Insurance Coverage Pennsylvania-based Erie Insurance has actually been insuring chauffeurs for almost 95 years, and its reputation for sterling service extends to young drivers.

"If there is a young motorist on your policy who is ... away at college without a vehicle," states Ruiz, "you might likewise get approved for a lower rate." Every insurance coverage provider provides different discount rates depending upon your coverage choice and other factors, so it pays to inspect which ones use to you prior to registering.

The Greatest Guide To Car Insurance For Teenagers - Moneysupermarket

It's also a fact that teen boys are more costly to contribute to a policy than teen ladies, as they're most likely to be included in a serious car accident. Progressive deals a range of discount rates for university student to minimize vehicle insurance coverage. Progressive How do you choose the very best protection? The finest protection for you is the one that fits your requirements, addresses your issues, and makes good sense for your circumstance.

2021 I Drive Safely We Develop Safer Drivers.

Your daughter or son has talked about it permanently - the day they lastly get their chauffeur's license. With that new self-reliance comes some huge expenditure - in the form of greater insurance coverage rates. In truth, parents of a brand-new teenager motorist can anticipate their insurance coverage expenses to practically double, according to a recent research study.

Some Known Facts About Car Insurance For Young Drivers And Teens - Usaa.

Nationally, the average boost was 79. 73 percent, Insurance coverage, Estimates. com reports. For moms and dads of drivers in their teens and early 20s - there is some hope. Insurance business do generally offer a range of discount rates that can help in reducing the bottom line. Here are eight things you can do to lower car insurance premiums if you have a teen motorist: If your teen chauffeur is a great student you might get approved for discounts.

Your insurance carrier may provide discounts if your teen takes part in a motorist security course. This may be a formal chauffeur's education course or it may be a course offered by your insurance coverage carrier straight.

This depends on your insurer. Note that some insurance provider do dissuade this considering that many students return house frequently and will need insurance protection to drive the car when they're back. A vehicle with extra safety choices and greater rankings may minimize your premiums. Sites like the Insurance Institute for Highway Security enable you to search for a lorry's security rankings.

The smart Trick of Teen Car Insurance - Usagencies That Nobody is Discussing

Once you've recognized the best automobiles and innovation, confirm with your representative whether these will decrease your insurance costs and by just how much. As a rule of thumb, an older automobile is typically a less costly insurance option for your teen motorist. Expensive, newer vehicles generally cost more to guarantee so there could be some savings if your daughter or son isn't driving the household's brand-new luxury sedan.

If the vehicle is actually old, you may even think about dropping this coverage all together, if possible. If you have separate insurance carriers for your house, cars and truck, or other products think about a multipolicy discount.

https://www.youtube.com/embed/_a0T57UOaeg

Additional sources utilized in this story.

AboutThe Best Guide To Auto Insurance Discounts

The greater you set your protection limitations, the more you'll spend for cars and truck insurance, because you're electing for increased monetary coverage. And the lower your deductible, the greater your rates, due to the fact that it suggests you'll pay less expense in the occasion of a covered loss. This suggests that you can reduce your rates by dropping your protection limits, or raising your deductible quantities.

Shop around for brand-new vehicle insurance coverage, If you have not searched for vehicle insurance coverage lately and you're aiming to save, you ought to most likely make this task a priority. A lot of vehicle insurance companies will raise your rates gradually, which is why searching for new automobile insurance coverage and comparing quotes from different providers can assist you find identical protection at a much better rate.

Even if you have several moving violations in the current past, time can be your buddy here. In a lot of states, moving offenses are dropped from your driving record after three years. 2. Buy an "insurance-friendly" vehicle The automobile you drive makes a huge distinction in your automobile insurance premiums.

When you do, make sure that car is automobile insurance-friendly. So prevent exceedingly pricey or stylish vehicles. At a minimum, the cost of your crash coverage will rise with the worth of the vehicle. Beyond costs, it's likewise essential to comprehend that certain lorries bring higher insurance coverage charges. For example, any vehicle that could be at least loosely interpreted as a sports vehicle will cost more for insurance coverage.

Auto Insurance Discounts Fundamentals Explained

Those features can result in lower insurance premiums. The very best way to set about this is to get a list of security equipment that will lead to a lower premium from your insurer. As soon as you do, make certain that any cars and truck you purchase incorporates as numerous as possible. Some examples consist of: a security system, traveler and rear seat airbags, and anti-lock brakes.

Take a defensive driving course If your driving record is below average, this can be a relatively fast method to reduce your insurance coverage premium. Some insurance coverage companies will provide a discount rate if you finish a protective driving course.

It may still deserve taking the course if it only consumes the cost savings for the very first year. After that, you'll get the advantage of the discount rate for each year afterwards. 4. Make the most of behavior-based discounts Good chauffeurs assist insurer earn money. Because of that, companies like Liberty Mutual beat the competitors by offering discount rates to those with clean driving histories.

Plus Liberty Mutual is huge on customization so that you're only paying for protection you require. All the discount rates that they can possibly find, I have actually found aid bring that total expense down. With auto insurance, it can definitely truly builds up. 5. Yes, it can pay to search Many individuals stay with the very same vehicle insurance coverage provider for many years, but that's not constantly the finest course of action.

The 10 Cheapest States For Car Insurance In 2021 - Us News - An Overview

You must compare car insurance rates from completing business a minimum of every two years. This is crucial since every year different business pick to cut their prices in order to attract brand-new company. They may provide discount rates that are very appealing when compared to the business that has been managing your auto insurance coverage for the past 5 years.

6. Move closer to work When you request vehicle insurance coverage, among the first questions you'll be asked is how many miles your daily round-trip commute is. Not remarkably, the shorter your commute, the lower your automobile insurance premium will be. This makes sense due to the fact that it indicates you'll be on the road less and decreases the possibility of being included in a mishap.

There are always many advantages to improving your credit, and the possibility of lower car insurance is yet another. 8. Increase your deductible I saved this one for last because it appears on virtually any list of ways to lower your car insurance premium. Even though it's a clich, it's still a really legitimate point.

You'll save money for each year in which you don't have a claim. One caution hereif you have a history of accidents in which you have filed claims, do not raise your deductible. Considering that submitting claims is relatively predictable, increasing your deductible will just increase your exposure, potentially costing you more money than you save.

Does Car Insurance Go Down At Age 25? - Valuepenguin Things To Know Before You Buy

Think about your circumstances and select which works finest for you. Find out more:.

Cars and truck insurance premiums can be expensive. The excellent news is that your automobile insurance coverage cost isn't set in stone, and several methods to lower your bill are within your control.

Consider Seasonal Driving Behaviors Are your insurance coverage requires the very same year-round, or do you drive less in certain seasons? Do you have a vehicle you only drive in the summer season, like a convertible or a motorcycle!.?. !? Use these concerns as a beginning indicate consider how your driving modifications throughout the course of a year.

As long as you leave detailed coverage on the automobile, it'll still be covered if it's taken or harmed in a fire. You can not legally drive a lorry with comprehensive-only protection.

Getting My How To Lower Your Car Insurance After A Ticket - Joy Wallet To Work

Always renew your liability insurance coverage (and any other protection required in your state) before taking your cars and truck back on the road. You can save 10% when bundling automobile and home insurance coverage with USAA and up to 25% with Allstate.

Typically, the higher your deductible, the lower your premium. For instance, Nationwide estimates that if you raise your deductible from $200 to $1,000, you might save about 40% on your insurance coverage premiums. If you raise your deductible, make sure you have actually adequate money reserved to pay it if you require to.

/GettyImages-1004420614-d368080d9b9742c2a9b97753639288ec.jpg)

Speak to your insurance coverage representative to see if you certify for car insurance discounts, such as:: An excellent way to minimize your premium is to be a good motorist. If you didn't have a moving violation in the past three or 5 years, you might be qualified for an excellent driver discount.

https://www.youtube.com/embed/DbQbCJK6OR0

Inquire about a military discount, even if you don't see one advertised.: Teens can be costly to guarantee, but full-time high school or college students with at least a B average are usually eligible for a great student discount. If your kid is away at college and doesn't have a cars and truck with them, ask your agent if you're eligible for a "student away at school" discount rate.

AboutThe Best Cheap Car Insurance In Nevada - Business Insider - An Overview

Both in-person and online alternatives normally exist, making these courses available. Great grades: Other insurance coverage companies have been known to use discount rates for great grades and not all of them are just for straight-A students.

Far from home: If you have a teen in college far from house and without a car, you might have the ability to get a discount rate considering that your teen isn't driving regularly. The range may vary from insurer to insurer, but we've seen discounts used for teens that lie at a college or university 100 miles from house.

Whether your teenager will be driving your automobile or getting an automobile of their own, you must consider an utilized model. In an effort to prepare for the risk, you'll see an even greater insurance rate for a teenager who will be driving a brand-new car.

The Single Strategy To Use For Teenage Car Insurance: What To Know - Trusted Choice

Insurance companies aren't simply fretted about the risk of damage to the car, but likewise about the threat of damage to the individuals inside it. Investing in a vehicle with an excellent safety rating can assist you lower your insurance expenses.

What amount can you spare each month for a vehicle loan? Start by figuring out the price range you can conveniently pay for. Think about just how much you earn, the quantity of savings you have and how much you already invest monthly. If you can manage the complete expense of the car upfront, you might be able to request for a discount rate and save a large quantity on interest.

Think About a Used Lorry, Next, you'll have to think about whether you wish to acquire a new or secondhand automobile. For your teenager motorist, you may wish to consider buying a used automobile. Though they may not include all the upgraded features of the newest design, utilized vehicles can still make reliable vehicles for teens.

How 6 Ways To Trim The Cost Of Car Insurance For A Teen Driver can Save You Time, Stress, and Money.

Depending on the model, a used car might have as many security features as a new car. Depending on whether you or your teenager are spending for the car, a used cars and truck may be the only alternative that fits within the budget. Of course, you'll want to work out caution when acquiring an utilized vehicle.

3. Take a look at the Safety Records, When you discover a car you and your teenager like, you might want to check the safety scores from the Insurance Institute for Highway Safety or the National Highway Traffic Safety Administration (NHTSA). You can easily browse for a vehicle based upon its year, make and model to figure out whether it's safe enough for your kid.

If you look for your automobile through NHTSA, for instance, the car will be rated on a 5-star scale. 4. Read Reviews and Upkeep Records, You can read reviews about a lorry online to learn what other drivers like and do not like about the cars and truck. Reviews can be more trustworthy than the info you get from a prejudiced source like a sales representative.

The 3-Minute Rule for Should You Add Your Teen Driver To Your Car Insurance ...

This is a comprehensive report that utilizes the cars and truck's VIN number. In this report, you'll learn the critical information about the lorry, such as its upkeep records, the number of owners the vehicle has had, any accidents the automobile has actually been involved in, title details, liens, flood damage and air bag implementations.

Examine Insurance Coverage Rates Before You Buy, Prior to you buy a car, inspect what insurance rates are like. Even if teens tend to be pricey to guarantee, discovering the right car can assist you get an excellent insurance coverage rate.

Test Drive With Your Teenager, While research study can be extremely beneficial, nothing can give you a better concept of whether a car is an excellent option for your teen than a test drive. A vehicle that sounds great on paper might not deal with as well as expected. For new motorists, test driving a number of designs is especially important, as this enables your teenager to learn how efficiency varies from automobile to automobile.

Things about How To Save On Your Teen's Auto Insurance - Cbs News

While telematic innovation can be an outstanding method to save on teen vehicle insurance coverage, the savings portion does usually have a limit with these programs. The limitation differs for each insurer, however connecting to your insurance agent will give you a concept of what's available to you and how to start.

If you opt to have telematics installed on the automobile, you might be able to get two discounts, assuming your teen's driving practices are safe and his/her mileage is low. Consider Getting Another Automobile Insurance Plan, The presumption is generally to add your teen to your existing policy, regardless of how expensive it may be.

In this case, if you do have that brand-new BMW or another high-end sports car, a separate policy will likely be more inexpensive. Clearly, insuring your teenager to drive your luxury sports cars and truck would likely make the cost sky-high. The 2nd situation when a separate policy might make good sense is if your teenager works and aspires to be independent and take on the duty of having an automobile insurance policy totally free of Mother and father.

How Much Is Auto Insurance For A 16-year-old? Fundamentals Explained

While this perk isn't specific to teenage chauffeurs, it can considerably help in offsetting the costs if you have a teenager on your car insurance coverage strategy. It's likewise not restricted to house and automobile insurance coverage you can add other policies you may have in place, such as for boats and bikes.

If you include your teenager to your policy, see the rates escalate and then concern learn your insurance provider doesn't provide lots of or any of the incentives we have actually pointed out, it may be time to take your company somewhere else. Insurance provider are always interested in having new consumers, so you might be happily shocked at the deals you can get by searching.

With time, staying ticket- and accident-free conserves you a significant quantity of cash. In some cases, it may make good sense to postpone getting a chauffeur's license to ensure your teenager has had adequate practice and comprehends the requirement for being a safe motorist. Nevertheless, it's essential to balance that with not letting our fears obstruct of our teenager's knowing and experience on the road.

Little Known Facts About How To Get Cheap Car Insurance For Young Drivers.

https://www.youtube.com/embed/0xHOZvUCJhIHowever, it's equally crucial for them to understand a few of the basics about car insurance coverage, and the obligations that come along with driving. Getting a cars and truck insurance coverage discount rate can be in their hands. Safe Driving Tips for Teens That Can Lower Your Insurance coverage, In addition to checking out these rewards to minimize the cost of teen automobile insurance coverage, it's also essential to have a discussion with your teen about safe driving.

AboutFascination About How To Find The Best Cheap Car Insurance For New Drivers - The ...

You can examine the website of the National Association of Insurance Coverage Commissioners to see the number of consumer grievances have been filed against a business you're considering, or read Nerd, Wallet's car insurance coverage evaluates. You may decide it deserves paying slightly more for a policy from a business with better customer support.

Avoid a lapse in coverage by setting the cancellation date for your old policy for after the start date of the new one. You should get a refund of any unused premium you paid your former insurance provider, minus any cancellation fee. Often asked questions, Can you get cars and truck insurance coverage instantly? Yes.

How do I get automobile insurance for the very first time? For young motorists, being added to a parent's insurance coverage policy is frequently the most budget-friendly option.

1. Know your state's minimum car insurance coverage requirements, If you're driving an automobile, then you're lawfully required to have automobile insurancespecifically, liability protection. Liability covers the costs for other individuals and home, if you trigger a mishap. In some states, liability is the minimum legal requirement. In other states, you're required to have additional coverages as well.

All about How To Buy Your First Car - Comparethemarket.com

Keep in mind that you may be required to have extra protection, if you're financing or renting your cars and truck. Examine with your lease or loan business to be sure.

We likewise stroll you through your coverage alternatives, and reveal you how adding protections, and choosing deductibles Look at more info and limitations will impact your ratein actual time. 2. Find out about optional coverages, so you can make the very best decision for your needs, Liability covers other individuals and home when you trigger a mishap.

The more protections you have on your policy, the more your policy will cost. It's a matter of weighing the quantity of risk and the expense you are comfortable withwhat you can afford to pay of pocket for cars and truck insurance versus what you could afford to pay of pocket for residential or commercial property damage or injuries without it.

If you have crash protection, your insurance would help with those costs. 3. Your excellent driving could assist lower your rate, Traditional insurers base your rate primarily on things like your demographics and driving record. They presume more youthful or less knowledgeable drivers aren't as excellent behind the wheel and charge them more as a result.

Some Known Incorrect Statements About Auto Insurance

Reviews will inform you how a vehicle insurance company treats its consumers, if they offer reasonable rates, or if they make handling difficult thingslike claimsconvenient and simple? You can learn a lot from a cars and truck insurance company's site, see what their consumers are saying about them to really get an image of what choosing that business will look like in the long run.

5. Understand what's covered under your vehicle insurance coverage, When you have actually done all your research study and compared various automobile insurance companies, it's time to select your policy. Make certain you understand what's covered and what's not. You don't desire to understand you're not covered for something after you require it.

Or, have a moms and dad or friend who has years of automobile insurance experience have a look. Then, when you feel excellent about the policythe price you'll pay and what's coveredyou'll know you have actually actually done your due diligence and selected the car insurance that's right for you. And, if for some factor you end up being disappointed with your coverage or wish to include or get rid of coveragesremember, you can always alter your automobile insurance later.

What you pick for your first automobile insurance coverage policy doesn't need to be permanently, so do your research study and make the finest choice for you now, understanding you can always alter it later on. All set to see if Root is the very best alternative for your first cars and truck insurance plan?.

What Is A Car Insurance Premium? - Credit Karma Things To Know Before You Get This

Newbie chauffeurs have a lot to learn prior to easily strolling the country's roadways and highways. Car insurance coverage might not be the very first thing a new driver thinks of, but possibly it must be. It's a crucial aspect of a every motorist's duties, not simply for their own peace of mind, however for other chauffeurs on the roadway.

When chauffeurs do think about vehicle insurance coverage, the expense is often the primary issue, in addition to having the ideal type of coverage. Adding a new driver to an existing policy is the easiest and most affordable way to get covered. Here we explain why first-time chauffeurs need to sign up with an existing plan, in addition to some additional cost-saving ideas.

New drivers are thought about high risk by insurance coverage business. To get the finest rate, store around, and then shop around again prior to it's time to restore. Perks of Being Added as a Driver Aside from the obvious benefit of being covered by insurance, there are numerous reasons that newbie drivers need to think of joining an existing policy, instead of looking for out a new policy for themselves.

https://www.youtube.com/embed/DmDDyfrHOoY

One of the factors cars and truck insurance companies seek to when estimating costs is the chauffeur's existing status, and history of protection. Uninsured chauffeurs are often thought about "high-risk." High-risk motorists pay a higher premium than a standard or preferred motorist. A shortcut around having no previous insurance coverage is to be added as a chauffeur on an existing policy, such as that of a parent, sibling, or partner.

AboutNot known Factual Statements About Tips To Getting Car Insurance For Teenagers - Lovetoknow

How to Get the very best Offers on Car Insurance Coverage as a Teen Earning a chauffeur's license is an exciting moment for many teens. Obviously, this likewise suggests that it's time to get guaranteed. Considering that protection can seem rather pricey for new drivers, it's a good idea to check out ways to get the best deals on auto insurance for teenagers.

Maintain Great Grades in School Did you know that insurance suppliers reward students for keeping good grades in school? No matter if your teenager remains in high school or college, they could get a discount by reporting their GPA to the insurer. While the grade requirement may differ, teenagers must prepare on maintaining at least a B average to be thought about for a flat-rate or portion discount rate on their vehicle insurance coverage.

Doing this will offer you a concept on which business will supply you with the best rates for the plan you desire. One choice to think about is an umbrella plan with a relied on family member. With an umbrella plan, multiple chauffeurs and lorries are covered under one policy, thus offering discount rates on the additional motorists added.

Examine This Report on Add Teen Car Insurance To Your Policy - State Farm

Nevertheless, this alternative will need a serious conversation with your teenager in advance. Make sure your teenager understands they are accountable for their own part of the insurance cost plus any raises in premium triggered by them prior to consenting to add them to your policy. Practice Safe Driving No matter your age, practicing safe driving will not just safeguard you on the roadway, but it will also secure the rates you pay to your insurance provider.

The amount you'll pay for car insurance coverage is affected by a number of extremely different factorsfrom the type of coverage you have to your driving record to where you park your vehicle. You might likewise pay more if you're a new chauffeur without an insurance coverage track record. The more miles you drive, the more opportunity for mishaps so you'll pay more if you drive your car for work, or utilize it to commute long distances.

Talk To Your 13-year-old Now About Cars And Insurance for Beginners

Insurance companies normally charge more if teenagers or youths listed below age 25 drive your cars and truck. Statistically, ladies tend to get into fewer accidents, have fewer driver-under-the-influence accidents (DUIs) andmost importantlyhave less major accidents than men. All other things being equivalent, women typically pay less for vehicle insurance coverage than their male counterparts.

Comparable to your credit report, your credit-based insurance coverage score is an analytical tool that anticipates the possibility of your suing and the likely expense of that claim. The limitations on your fundamental vehicle insurance coverage, the quantity of your deductible, and the types and quantities of policy choices (such as accident) that are prudent for you to have all affect how much you'll pay for protection.

Finest automobile insurance coverage for brand-new young chauffeurs and how to get it. Lilah Butler, Automobile Insurance Author, Oct 21, 2021.

The 10-Minute Rule for How Can You Lease A Car For A Teenager? - Grand ...

How Does the Teenager Safe Chauffeur Program Work? The app scores each flight and makes it clear where your teen can improve, while making it enjoyable to challenge themselves to achieve greater scores.

The discount will be immediately applied up until the renewal after your teen turns 21. The discount will be removed at the next renewal if your teenager incurs any of the following: A significant violation or numerous small violations. The Teen Safe Motorist program is totally free to American Family automobile insurance customers (information charges may use).

It's everything about helping your teen develop safe driving routines. If I Sign Up for the Teenager Safe Driving Program, Will a Discount Be Applied to My Policy? Yes! When your teen reaches the goal of finishing 3,000 driving miles on the road or driving for one year in the Teen Safe Chauffeur program, a discount rate of approximately 10% * will be used on their vehicle insurance coverage for taking part.

More About Car Financing For Teens - How It Works - By Leaseguide.com

Download the Teenager Safe Chauffeur App After talking with your representative to register in the program, you can download the Teen Safe Chauffeur app from the App Store or Google Play.

Insurance coverage, Possibilities are your 7th or 8th grader has no concept how insurance works. The policy they'll require in order to drive lawfully in your state provides a real-word lesson. Pull out your present car policy and explain the coverages and your annual premium. Then inform them that including a 16-year-old to the policy will likely more than double the premium.

Lots of insurance providers offer a premium discount of 5% to 10%, or more, if the insured teenager has a high GPA. You have actually simply provided them a year or 2 to double down on studying.

Some Known Factual Statements About Us News Reveals The Best Cars For Teens - Press Room

Security, Teens are so pricey to insure due to the fact that they have more mishaps. According to the Insurance Info Institute, 16-year-olds account for, on average, nearly 25 crashes for every million miles driven. From ages 20 to 24, the crash rate of 9.

And for the record, the rate for drivers between the ages of 40 and 79 is listed below 4. 0. Lack of experience is an issue, however so, too, are poor options. A study by the Centers for Disease Control discovered that more than 40% of high school students do not always wear a safety belt, nearly 40% texted while driving, and 17% entered into a vehicle where the driver had actually been drinking.

And you know your kid best: Think of the best quantity, and kind, of information to get their major attention without triggering nightmares. The ideal vehicle, If the strategy is for your teen to have their own car, this is where you can impart monetary lessons that will pay off for the rest of their life.

The Facts About Best Car Insurance For Teens And Young Drivers (2021) Revealed

By comparison, less than 30% of adult miles driven remained in cars that old. Provided the big advances in automobile security tech over the previous years, older designs will likely lack some safety features. Also, avoid little "enjoyable" cars and trucks that teens may be naturally brought in to. They do not tend to use the same security in a crash as a larger automobile (specifically when the other cars and truck in a crash is a huge SUV).

https://www.youtube.com/embed/gu4AU2rVafE

2021 I Drive Securely We Develop Safer Drivers.

AboutThe 5-Second Trick For How Insurers Determine That A Car Is A Totaled Car - Carsdirect

However the greatest aid to getting more cash for your cars and truck is normally area sales for the exact same year make and model that show it was worth more than the deal you got. Work out by having evidence that your car would have been worth more if offered, in the condition it was in the day prior to the accident.

Why? If the insurer considers your automobile a total loss, they will pay you for that lorry however then take ownership of it to try to recoup a few of their payout. If there's still cash owed on your car, your lending institution owns the automobile and so when your insurer pays them off, the insurance provider will get the title signed over to them.

All about What Happens If An Accident Totaled My Car? - Robotics ...

This document is where you consent to the actual money worth they have assigned your cars and truck. Now that the insurance provider has figured out the overall loss, the worth of your amounted to automobile and you've checked in contract; it is time for the check to be launched. If you funded the automobile, your funding business will get the check (or it will remain in joint names and you'll sign it over to them).

If you are upside-down on your car, owe more than it's worth, you might still be left owing the finance business unless you have space insurance coverage that pays that quantity for you. If you do not have a loan on the automobile, you will get the complete check and might utilize that cash toward a replacement automobile unless you decide to take the bus from now on and pocket the cash instead.

Rumored Buzz on Total Loss Auto Claims With Your Insurance Company - Illinois ...

So, how do you get a new automobile after a total loss? Probably not, though it is okay to consult your insurance coverage company. Some major insurance provider will change the vehicle if it's a brand-new automobile. But for the most part, you will be the one acquiring a replacement car.

Be sure to talk with your claims adjuster or insurance coverage representative, but you're looking at a couple of weeks to a month. Insurance providers don't like to drag these things out, specifically if they're spending for you to drive around in a rental car. The majority of states have a schedule in which insurance providers should process claims, so if you feel it has actually been an unreasonable quantity of time, get in touch with the consumer department of your state's department of insurance for assistance.

The Best Strategy To Use For How Much Does Insurance Pay For A Totaled Car In North ...

This is a not-so-good scenario if you do not have $3,000 in savings. Your policy may have gap insurance coverage, which suggests that your insurance company will pay $5,000 to your lender and the $3,000 gap to your lender (so the full $8,000 on the cars and truck). This is the perfect circumstance. You may be able to keep your amounted to automobile-- it depends upon your insurance company and state.

The property damage claim for your car after a mishap can be surprisingly complicated, and you might have numerous choices to make. If you have accident insurance protection, you may desire to make your property damage claim with your own insurance coverage company to receive better consumer service and the possibility of having your claim paid quicker.

The Basic Principles Of My Car Was Totaled! Now What?

If your automobile is fixed, you might likewise be entitled to a lessened value payment. This is to compensate you for the decrease in the worth of your vehicle. The insurance adjuster will total your vehicle if the cost of fixing it is more than it is worth or if it would stay hazardous after the needed repairs were completed.

If you acquired Replacement Cash Value (RCV) coverage, you would be paid the expense to change your automobile with a similar brand-new one. You might choose to keep your totaled automobile and pay to have it fixed instead of replace it. You can do this, but the salvage expense will be subtracted from what you are owed and a salvage title would be provided.

5 Simple Techniques For Will A Collision Repair Shop Fix Your Totaled Car?

This quantity is deducted from the ACV to identify just how much you are paid. Using the example above of a car with an ACV of $13,000, 10 percent would be $1,300. This amount and your deductible would be subtracted from the ACV to get to the quantity you should get if you keep your amounted to automobile.

If you have a history of mishaps, you can anticipate an even steeper rate hike due to the fact that you will look like a risky driver. Comprehensive coverage steps in when your vehicle is damaged, however it is not connected to a crash. You might file a detailed claim since your automobile was stolen or vandalized or since a tree limb fell on it, for example.

The 20-Second Trick For When Your Totaled Car Isn't Paid Off - Insurance.com

Now they understand you drive in a manner in which you may cause an accident, they perceive you to be a riskier motorist and they have your mishap to back that perception."Having a mishap or a moving infraction on your driving record is a red flag to insurers, which typically causes your automobile rate to increase substantially," states Adams.

There are both advantages and disadvantages to changing insurance coverage suppliers, so make sure you weigh both sides prior to you do it. Accident forgiveness programs, If you were registered in a mishap forgiveness program prior to your accident, you might be qualified to have the claim additional charge waived. Although guidelines vary by provider, the majority of mishap forgiveness programs are created to waive the first at-fault loss that happens on your policy and will waive just one loss within a specified timeframe, like three or five years.

The Ultimate Guide To Auto Insurance Guide - Minnesota.gov

The specific length of time depends on your state and the seriousness of the incident., an accident or offense will remain on your record for five years.

You can examine your state's DMV website for details about driving record requirements where you live. Decreasing your cars and truck insurance coverage rates after an accident, The larger question other than how much your cars and truck insurance will rise after a mishap is how do you get the most affordable possible premium now that your mishap lags you.

Rumored Buzz on Don't Let A Totaled Car Total Your Wallet - Hanover Insurance

"You might get approved for discounts such as driving fewer miles, being an excellent student or having one in your home, and working in certain service-related occupations (such as mentor, health care, or the military)."Here are some ways to reduce your car insurance rate after a mishap: Your credit ranking contributes in determining your cars and truck insurance coverage rate in some states.

https://www.youtube.com/embed/tAnJPknzMYQ

It's always a terrific concept to look around and find the very best prices presently being offered from business to business. You might also discover that some companies offer different discount rates and protection alternatives than others. If you absolutely need to lower your insurance coverage premium, you could consider altering your protections.

AboutThe smart Trick of Distracted Driving Laws Make A Difference In Rates Of ... That Nobody is Tal

How to Get the Finest Deals on Car Insurance as a Teenager Earning a motorist's license is an exciting moment for numerous teenagers. Obviously, this likewise means that it's time to get guaranteed. Considering that coverage can seem rather pricey for brand-new drivers, it's an excellent idea to check out methods to get the best deals on vehicle insurance for teens.

Preserve Excellent Grades in School Did you understand that insurance companies reward trainees for preserving excellent grades in school? No matter if your teen is in high school or college, they might get a discount rate by reporting their GPA to the insurance provider. While the grade requirement might vary, teens must plan on preserving a minimum of a B average to be considered for a flat-rate or percentage discount rate on their cars and truck insurance coverage.

Doing this will offer you a concept on which company will provide you with the very best rates for the strategy you want. One alternative to think about is an umbrella plan with a relied on member of the family. With an umbrella strategy, several motorists and cars are covered under one policy, therefore supplying discount rates on the extra drivers included.

Not known Factual Statements About Us News Reveals The Best Cars For Teens - Press Room

However, this option will require a serious discussion with your teen ahead of time. Make certain your teenager understands they are accountable for their own part of the insurance expense plus any raises in premium triggered by them before consenting to include them to your policy. Practice Safe Driving No matter your age, practicing safe driving will not only safeguard you on the road, but it will likewise protect the rates you pay to your insurance provider.

The amount you'll spend for car insurance coverage is affected by a variety of very different factorsfrom the type of coverage you have to your driving record to where you park your car. While not all business use the same criteria, here's a list of what frequently determines the bottom line on your automobile policy.

If you have actually had mishaps or severe traffic infractions, it's most likely you'll pay more than if you have a clean driving record. You might also pay more if you're a brand-new chauffeur without an insurance coverage performance history. The more miles you drive, the more possibility for accidents so you'll pay more if you drive your vehicle for work, or use it to commute long ranges.

The smart Trick of Buying A Good First Car For A Teenager: 10 Tips That Nobody is Discussing

Insurance companies normally charge more if teens or youths listed below age 25 drive your cars and truck. Statistically, ladies tend to get into fewer mishaps, have less driver-under-the-influence accidents (DUIs) andmost importantlyhave less major accidents than guys. So all other things being equal, women typically pay less for automobile insurance coverage than their male counterparts.

Similar to your credit history, your credit-based insurance coverage score is a statistical tool that forecasts the possibility of your suing and the likely expense of that claim. The limits on your basic car insurance coverage, the amount of your deductible, and the types and amounts of policy alternatives (such as collision) that are prudent for you to have all impact just how much you'll spend for protection.

Best automobile insurance coverage for new young motorists and how to get it. Lilah Butler, Car Insurance Coverage Writer, Oct 21, 2021.

Cosigning An Auto Loan With Your Child: Is It Ever A Good Idea? for Beginners

How Does the Teen Safe Chauffeur Program Work? This ingenious program supplies parents with a reliable method to help their teens master safer driving practices that can last a life time. Our unique app efficiently lowers distracted driving along with other dangerous behaviors that prevail amongst teenagers. The app ratings each ride and makes it clear where your teen can improve, while making it enjoyable to challenge themselves to accomplish higher ratings.

The discount will be automatically applied until the renewal after your teenager turns 21. The discount will be eliminated at the next renewal if your teen sustains any of the following: A significant offense or several small infractions. Multiple at-fault accidents. A small offense and an at-fault mishap combined. What Is the Expense of the Teen Safe Driving Program? There is none! The Teen Safe Motorist program is free to American Household car insurance customers (data charges may apply).

It's everything about assisting your teenager establish safe driving habits. If I Sign Up for the Teen Safe Driving Program, Will a Discount Be Applied to My Policy? Yes! As soon as your teenager reaches the objective of finishing 3,000 driving miles on the road or driving for one year in the Teenager Safe Chauffeur program, a discount of as much as 10% * will be used on their automobile insurance coverage for getting involved.

9 Easy Facts About Best Car Insurance For Teens And Young Drivers In 2021 - Cnet Explained

Download the Teenager Safe Motorist App After consulting with your representative to enroll in the program, you can download the Teen Safe Motorist app from the App Shop or Google Play.

Insurance coverage, Possibilities are your 7th or 8th grader has no idea how insurance coverage works. The policy they'll need in order to drive legally in your state offers a real-word lesson. Take out your current car policy and describe the protections and your annual premium. Then inform them that adding a 16-year-old to the policy will likely more than double the premium.

Lots of insurance companies use a premium discount of 5% to 10%, or more, if the insured teen has a high GPA. You have actually simply given them a year or 2 to double down on studying.

The Best Guide To How To Add A Teen Driver To Your Car Insurance - Reviews.com

Security, Teens are so expensive to insure due to the fact that they have more mishaps. A lot more. According to the Insurance Information Institute, 16-year-olds account for, typically, almost 25 crashes for each million miles driven. For 17-year-olds, it drops to 21. 1 crashes. From ages 20 to 24, the crash rate of 9.

And for the record, the rate for motorists in between the ages of 40 and 79 is listed below 4. 0. Lack of experience is an issue, but so, too, are bad options. A survey by the Centers for Disease Control found that more than 40% of high school trainees don't constantly wear a seat belt, almost 40% texted while driving, and 17% entered an automobile where the chauffeur had been drinking.

And you understand your kid finest: Think of the right amount, and kind, of information to get their serious attention without causing problems. The right automobile, If the plan is for your teen to have their own automobile, this is where you can impart monetary lessons that will settle for the rest of their life.

Our Teen Drivers In New Mexico Are Deadly Road Hazards Ideas

By contrast, less than 30% of adult miles driven were in vehicles that old. They don't tend to offer the very same protection in a crash as a larger vehicle (especially when the other automobile in a crash is a huge SUV).

https://www.youtube.com/embed/h2V5LejYVW8

2021 I Drive Securely We Build Safer Drivers.

AboutThe Single Strategy To Use For How Much Does Insurance Go Up After An Accident?

What Takes place When Your Vehicle Is Amounted to? An overall automobile loss can occur in many circumstances.

/is-my-car-totaled-527100-Final-5c4751d246e0fb0001b417d2.png)

The payout is based on the reasonable market value, or Actual Money Value (ACV). If you have accident and comprehensive coverage options on your automobile policy, then your total loss is paid at ACV minus your deductible. ACV is simply a term for what was when called the "book value" of the automobile, Miller describes or the value of your lorry when representing the devaluation that all cars and trucks start sustaining as quickly as they leave the lot.

They will want to understand if it's a loan, how much do you owe," Miller states. That's because you may owe on the automobile more than the carrier pays out, or you might not be current with payments on your vehicle loan.

Not known Facts About Does The Insurance Company Have To Pay For A New Car If My ...

Gap insurance coverage bridges the difference between what you owe and the amount of the payout from the insurance provider. If you do not have this optional coverage in your policy, then you need to come up with the rest. If You Want to Keep Your Cars and truck After It's Stated an Overall Loss, If your insurance carrier determines your cars and truck is a total loss, you may wonder if it's possible to keep your vehicle.

Does your state allow it? Some states have limitations on keeping a vehicle after it's amounted to. If you do plan to drive it, can it be totally repaired? Will your car pass an assessment once fixed? Do you have an insurance coverage provider that will insure a restored automobile!.?.!? If there is any doubt whatsoever about any of the points above, it's smart to carry on.

File An Insurance Coverage Claim, The sooner you file your claim, the better. The damage to your vehicle might be higher than you understand, and the insurance coverage provider must be involved from the start of the claim. Have Your Automobile Towed to an Authorized Body Store"Your vehicle does not have to go back to the car dealership," says Miller.

Fascination About How Much Will Insurance Pay For My Totaled Car? - Carbrain

"Collect Your Files, One of the most important steps is to remember to collect your files inside the car., an insurance consultant and professional with the Customer Federation of America.

"Consumers ought to firmly insist that they get all the costs of replacing the amounted to car," Heller says. This includes "the taxes and costs connected with purchasing a replacement car, as well as the refund of the license or registration charge from the totaled vehicle based on the staying regard to that registration." "if you paid $120 for the yearly registration of your lorry one month car insurance before your accident, you must get $110 added on to your claim settlement to cover the unused portion of the old cars and truck's cost."Obviously the insurance coverage provider might not see the worth in your car the way you do, and the payout might not equal what it costs to purchase a new vehicle.

If You Are Leasing an Automobile While Waiting Lots of drivers need a rental automobile while awaiting a decision on a payment, and usage insurance coverage to cover the rental expenses. But understand there is a limitation to rental car protection. After releasing your payout documents, insurance coverage companies will generally keep spending for the rental for a "day or two," Miller states.

The Definitive Guide for Is Your Car Totaled? — We Pay Cash For Total Loss Cars

If you owe more on the vehicle than what you're used, then you're responsible for the deficiency, unless you have space insurance.

Hop in the chauffeur's seat and buckle up as we discuss what it suggests when your car is totaled, whether your insurance provider will cover a totaled vehicle and more. What Does It Mean When Your Vehicle Is Amounted to? A basic auto insurance plan generally won't pay to fix your automobile if it's been totaled.

It differs from another term you might have heard relating to automobile insurance coverage: replacement expense value. Replacement expense describes what it would cost to buy a new cars and truck equivalent to one that's been amounted to. Not all vehicle insurance policies provide replacement cost as a choice. Your automobile insurance coverage premium will be higher if you go with replacement cost worth coverage instead of actual money value protection.

The 4-Minute Rule for What Happens When Your Car Is Totaled?

When you have an auto loan or lease, those 2 kinds of protection generally are needed. They aren't legal requirements on an automobile you've paid off, howeverthe decision to bring detailed or collision coverage is up to you. Without coverage beyond the liability insurance that's needed in nearly every state, you may have to pay of pocket to replace your totaled vehicle (specifically if you're at fault in the crash).

Accident insurance coverage applies when your vehicle is damaged during a crash with another automobile, an object or home. In many cases, an insurance provider may not cover a claim when your cars and truck is a total loss. Here are 5 possible factors for your claim being denied: You lack the appropriate coverage, such as detailed or accident.

https://www.youtube.com/embed/PaYC_nCth6A

You were driving while intoxicated. You took too long to report the damage to your insurance business. You submitted a deceitful claim. Keep in mind that each insurer uses different requirements for stating that a cars and truck is a total loss. A car that's amounted to by one insurance provider most likely would be amounted to by another.

About9 Easy Facts About What Happens If You Have A Car ... - Gjel Accident Attorneys Described

Currently, undocumented immigrants can legally obtain a motorist's license in Washington, D.C., and 12 states. With a legal chauffeur's license, the person can likewise purchase car insurance coverage and therefore avoid undesirable legal consequences.

References: This content is developed and maintained by a 3rd party, and imported onto this page to assist users offer their email addresses. You may be able to discover more details about this and comparable material at.

The Kentucky Legislature has mandated a crackdown on uninsured motorists throughout the Commonwealth. Owners of personal vehicles shown to have been without insurance coverage will receive notifications that registrations for their personal automobiles will be canceled if they do not obtain the required insurance or show proof of existing insurance coverage. The necessary insurance effort intends to plug an enforcement space that makes it possible for drivers to skirt the law by dropping protection once their automobiles have been signed up.

The 7-Second Trick For If I Don't Have A Car, Do I Need Auto Insurance?

According to the statute, an owner who stops working to keep insurance on his car will have his lorry registration revoked. In addition, the lorry owner, in addition to the vehicle chauffeur, go through a fine of $500. 00 to $1,000. 00, approximately 90 days in jail, or both.

This suggests liability coverage of $25,000. 00 for all claims for physical injury damages sustained by any a single person and not less than $50,000. 00 for all bodily injury damages sustained by all persons as an outcome of an accident, as well as $25,000. 00 for all home damage as an outcome of any one accident.

KRS 186. Guideline and Requirement If your automobile has an existing, active registration, you must keep insurance on that automobile.

See This Report on These States Do Not Require Auto Insurance. - The Balance

Some owners of seasonal automobiles such as bikes or RVs are accustomed to dropping the insurance on these vehicles during the months they are not being driven. To prevent charges for lack of insurance, the owners of these cars should turn in their license plate to the County Clerk's workplace prior to canceling their insurance plan when it is time to put the automobile back on the roadway, protected evidence of insurance coverage, and provide the proof to the County Clerk.

Much the exact same as seasonal vehicles, owners of vehicles with Historical license plates often drop the insurance while the car is not being driven but fail to surrender the license plate to the County Clerk's office. This will trigger an uninsured notice to be sent by mail since the Department of Motor Automobile Licensing has a record of a signed up lorry without an insurance plan being reported monthly.

When the time comes to get the vehicle back on the road, present evidence of insurance to the County Clerk's workplace, and the car can be registered.

Unknown Facts About Car Accident With No Insurance? What Could Happen - Credit ...

Exemptions Active service military Active duty military personnel can use out-of-state insurance to title and register any car entitled in their name here in Kentucky. When signing up an automobile, if it is taped as a basic individual policy at the County Clerk's workplace rather than a military personal policy, it will trigger the car to be flagged as being perhaps uninsured.

Uninsured Driver (UM) coverage is an extra protection that can be included to your cars and truck insurance coverage policy. If you're hurt in a car accident by an uninsured driver (a driver with no vehicle insurance coverage)or in some states, a hit-and-run driverthen Uninsured Vehicle driver protection might assist pay for your expenses.

* Some discounts, protections, payment plans and features are not available in all states or all GEICO companies. The above is meant as basic details and as general policy descriptions to assist you understand the different types of coverages.

9 Simple Techniques For Penndot Fact Sheet - Insurance Law

Even if you buy cars and truck insurance the next day, that policy would apply only to mishaps that happen after you buy it. The outlook is a little better if somebody else strikes you, given that the driver who's at fault normally is accountable for damage in an automobile accident. However state laws might restrict what sort of expenses you can recover if you were driving without insurance coverage because case.

What you have to pay after an accident with no insurance coverage, If you cause the mishap, In most states, if you trigger an accident, your insurance coverage business pays for the damage and injury expenses of victims. If you have no insurance coverage, the victims may sue you. The process is different in the 12 "no-fault" insurance states.

This indicates other people may not be able to sue you for medical expenses unless the injuries are severe or the tab reaches a considerable amount. Each state sets its own rules for the scenarios in which legal action is allowed. If another person causes the accident, Those without any insurance might be limited in what they can take legal action against the at-fault chauffeur for, depending upon the state.

Top Guidelines Of What If The Other Driver Doesn't Have Insurance? - Citywide ...

For example, newbie offenders in Texas deal with a fine of at least $175. In Minnesota, the same offense might carry a fine of up to $1,000, up to 90 days in jail and loss of your license and registration. If you have insurance, however no evidence, You must keep evidence of insurance coverage, such as the policy ID card, in your car.

If you trigger a mishap however have no evidence of insurance, it's less major than being uninsured. You may get a citation but might possibly get it dismissed by showing evidence of insurance coverage in court. An accident without any insurance coverage hurts future rates, We examined rates for motorists in California, Illinois and Texas who had actually triggered a mishap and were uninsured.

https://www.youtube.com/embed/02ADuS24fMM

Car insurance coverage prices if you cause a mishap without insurance Typical rate for good chauffeurs, Average rate with one at-fault crash, Typical rate with one at-fault crash and no proof of insurance, Rates for drivers who crashed without evidence of insurance were substantially greater than rates for good drivers. To a lower degree, they were likewise greater than the rates for insured motorists who had triggered a mishap.

AboutHow What To Do If You Can't Pay For Insurance Due To Coronavirus can Save You Time, Stress, and

Texas law states you need to show proof that you can pay for mishaps that you trigger. Many people do this by buying vehicle liability insurance coverage. Liability insurance coverage spends for the other driver's repairs and medical bills. If you still owe cash on your vehicle, your loan provider will require you to have collision and extensive coverage to spend for damage to your car.

The court could fine you up to $350. If it happens again, you might be fined approximately $1,000 and have your chauffeur's license suspended. Do I need space insurance coverage? Only if your vehicle is worth less than what you owe on your vehicle loan. Gap insurance covers the difference in between what you owe on your cars and truck and what it deserves.

A Biased View of Milewise From Allstate - Allstate Insurance Company

Am I covered if I struck an animal with my vehicle? Yes, if you have extensive coverage. This is the coverage that spends for damage to your car that isn't brought on by an auto accident. You'll most likely have to pay a deductible to get your automobile fixed. State law does not allow your company to drop you if you file a claim for hitting an animal, but it might raise your rate when you restore your coverage.

You could have an exception on your policy that states it won't cover individuals who are called as excluded motorists on the policy. If you aren't sure, ask your representative if you have this "called driver exclusion recommendation." If you have "rental compensation coverage" on your policy, it will spend for a rental cars and truck if your automobile was stolen or is being repaired because of an accident your policy covers.

Indicators on What Happens When Your Car Is Totaled? - Usaa You Should Know

Do I need to buy insurance when I lease a vehicle? If you have auto insurance coverage, call your agent to see what it covers when you drive a rental vehicle. Policies vary, however some cover damage to the rental vehicle from a wreck or theft. Learn more: Do I require to buy insurance coverage when I rent an automobile? Mexico does not recognize American automobile insurance coverage.

If you're driving into Mexico, you ought to purchase a Mexican liability insurance policy. Your homeowners or renters policy may pay if you have one of those policies. If you live with your moms and dads, their property owners or tenants policy may cover the things in your automobile.

Examine This Report on What Happens If You Don't Pay Your Car Insurance?